Educational

Bond Product Overview: Coverage, Features, and How It Works

Affordable, transparent, and comprehensive labelled bond dataset for your analysis needs

Sep 26, 2025 @ London

A comprehensive labelled bond dataset covering 32,384 bonds and $6.3 trillion in issuance since 2006. Easy to use, transparent pricing, and valuable for both pre-issuance and post-issuance analysis.

TL;DR:

Built to be affordable, transparent, and comprehensive — without hidden pricing or complexity.

- Easy to use — sign up to data in under 2 minutes

- Team-based pricing: £1,000/month or £10,000/year

- Consistent updates, broad coverage, and expert assessments

- Valuable for pre-issuance and post-issuance reporting, ownership analysis, and market slicing

- 32,384 bonds, $6.3 trillion issuance, 2006–2025

- Covers Green, Social, Sustainability, Transition, and SLBs

1. Getting Started: Two Minutes from Signup to Data

From signup to first data access takes under 2 minutes. Our streamlined onboarding process gets you exploring the dataset immediately.

2. Coverage: Scale, Types, and Regions

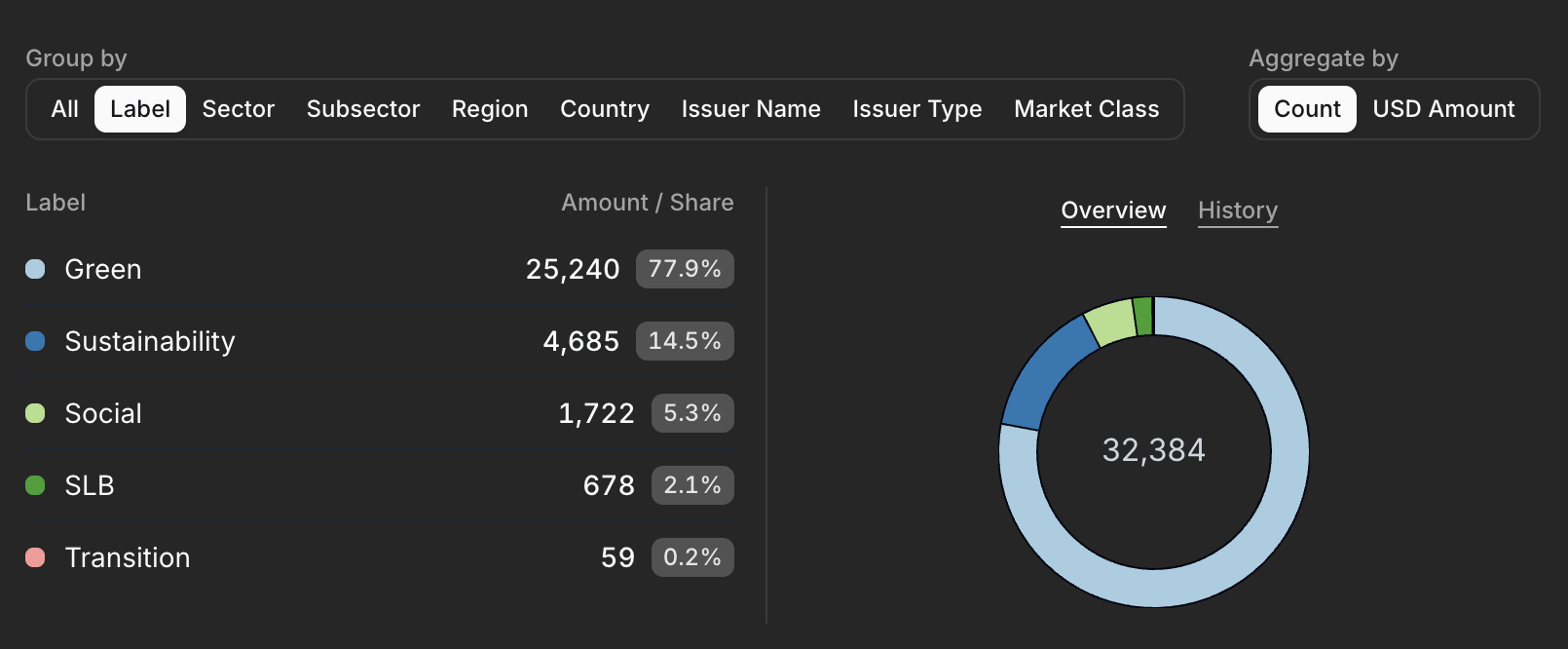

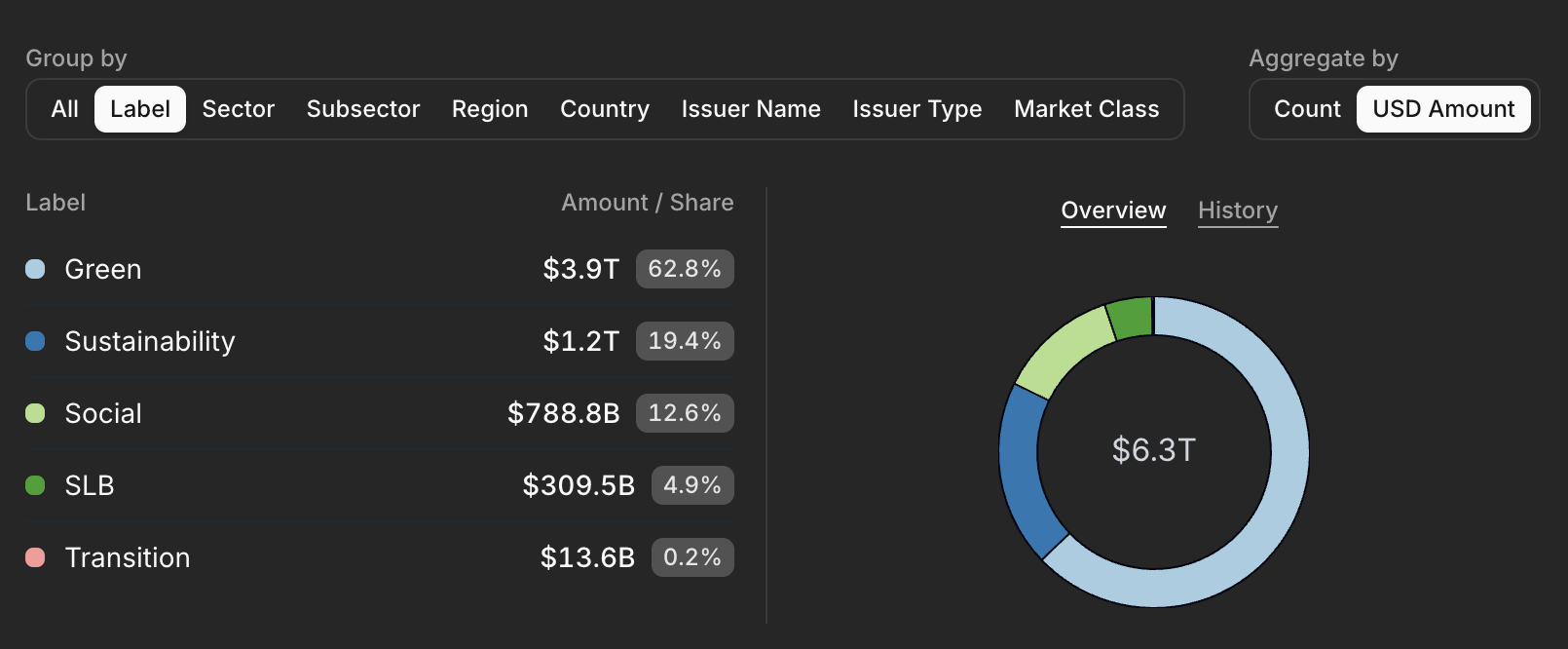

As of 26th of September, we cover:

- 32,384 bonds

- $6.3 trillion of issuance volume

- Coverage starting 2006, with updates:

- Daily for new bonds

- Weekly for pre-issuance documents

- Quarterly for post-issuance documents

- Instruments: Green, Social, Sustainability, SLBs, Transition

- Global scope: Asia (incl. China, Japan, Korea), South America, Africa, Europe, North America

- Non-English documents (e.g. French, Spanish, Japanese, Korean, Chinese) are translated into English

Bond count by label

Issuance volume by label

3. Data Sources and Updates

Sources: Bond reference data is primarily via Cbonds and historical data finds. Source documents are all sourced by ClimateAligned via web search and internet scraping.

Multilingual ingestion: French, Spanish, Japanese, Korean, Chinese → English

Frequency: daily new bonds, weekly sweeps, quarterly post-issuance reviews

4. Documents & Assessments

We capture the key documents needed for analysis:

- Frameworks

- Impact, allocation and post-issuance reports

- Second-party opinions

- Verification statements

- Select prospectuses (mainly municipal)

- Any public disclosure available on the bonds pre- or post-issuance

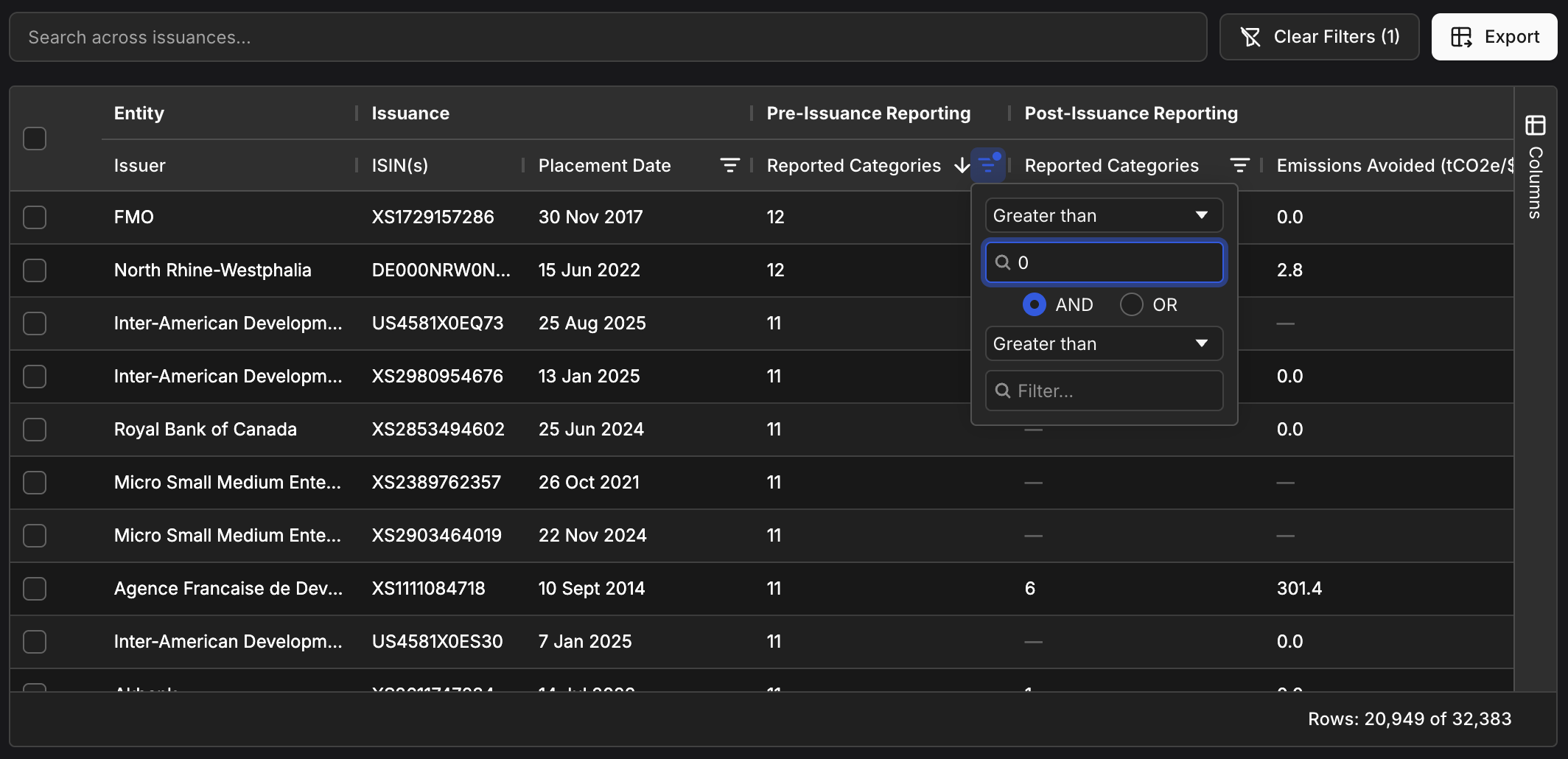

Document Coverage:

- ~20,900 issuances ($5.2T) with pre-issuance documents (83% of bonds by $-volume)

- ~9,200 issuances ($3.2T) with post-issuance documents (~50% of bonds by $-volume)

Our coverage is robust, and we are constantly improving it. Since we began collecting data in 2023, our coverage of older bonds (issued pre 2020) is less comprehensive, as sometimes relevant documentation for these securities was no longer available online by the time we started our collection efforts. We have most of the new issuance and the relevant documents if they exist. Note also that some post-issuance documents are not due yet for the newest issuances. Please reach out for coverage details on your portfolio.

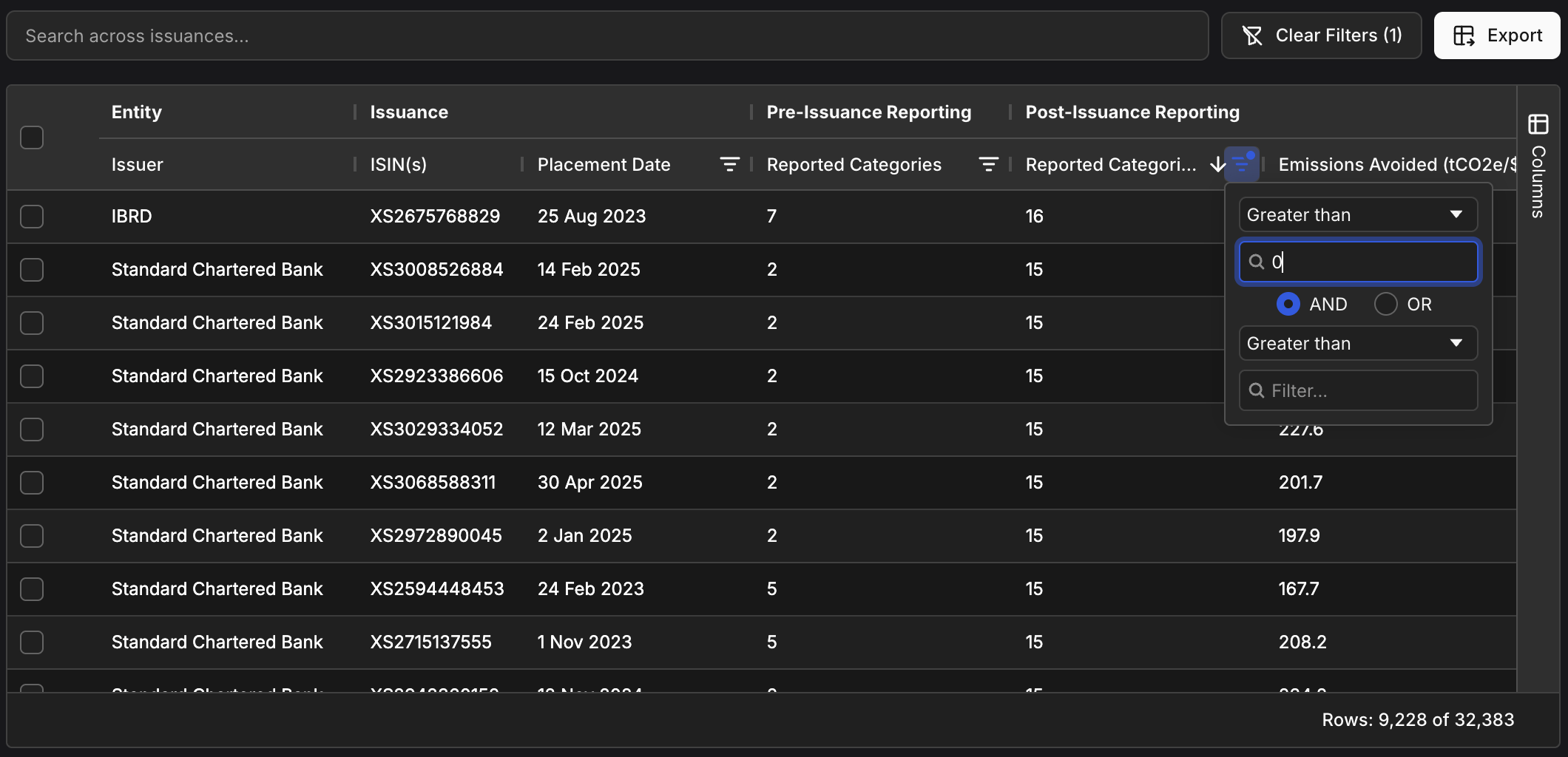

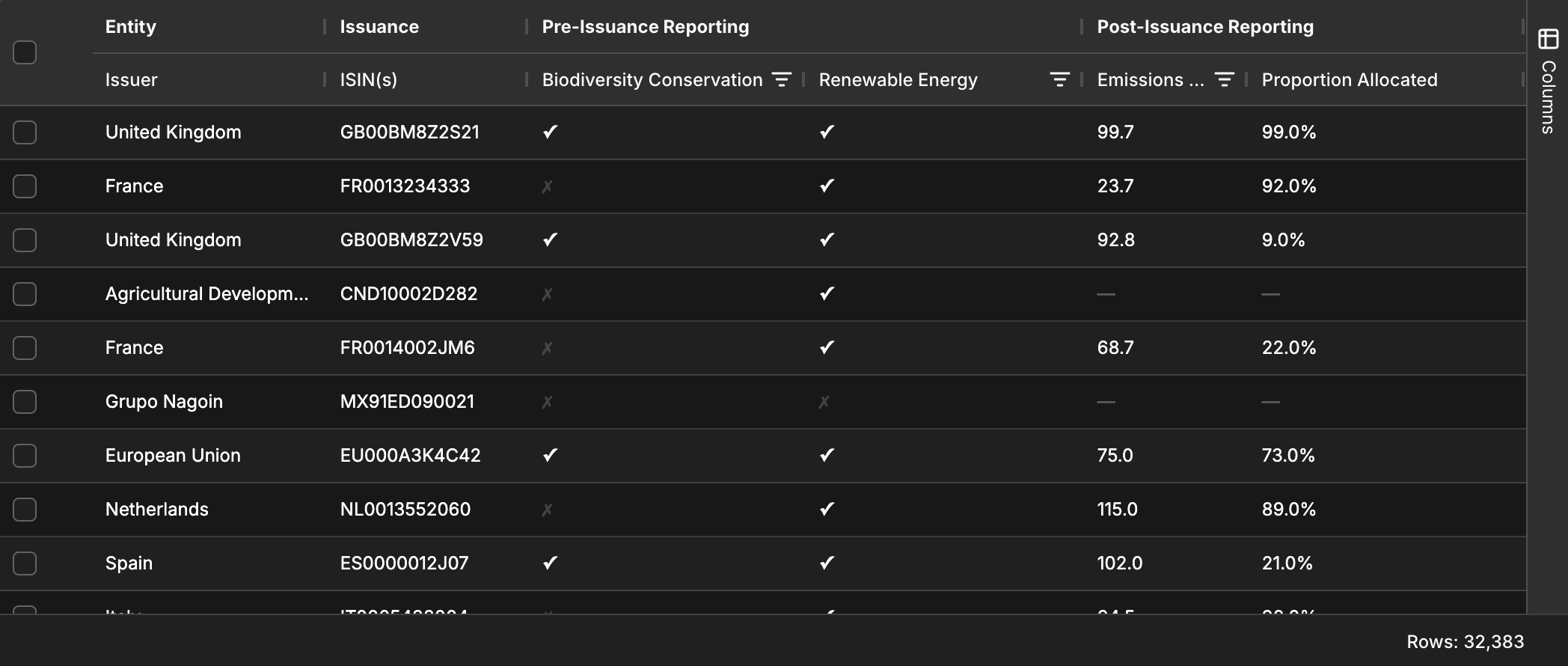

Filtering bonds with pre-issuance documents

Filtering bonds with post-issuance documents

5. Data Features

Pre-issuance Analysis

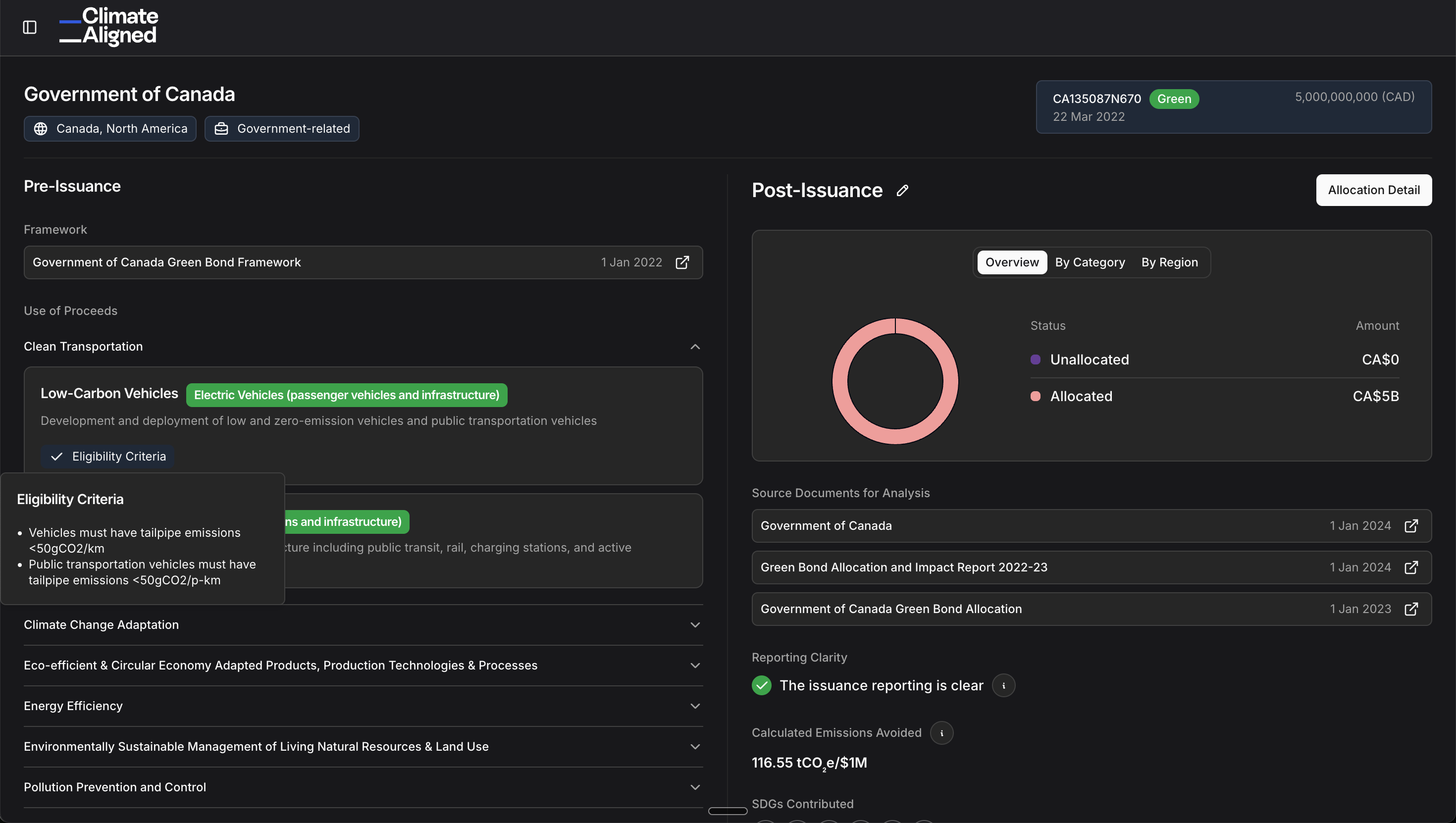

We extract pre-issuance Use of Proceeds data "as stated" using primarily ICMA Green Bond Principles and Social Bond Principles as categorisation. We include the eligibility criteria and other detail in the data as well.

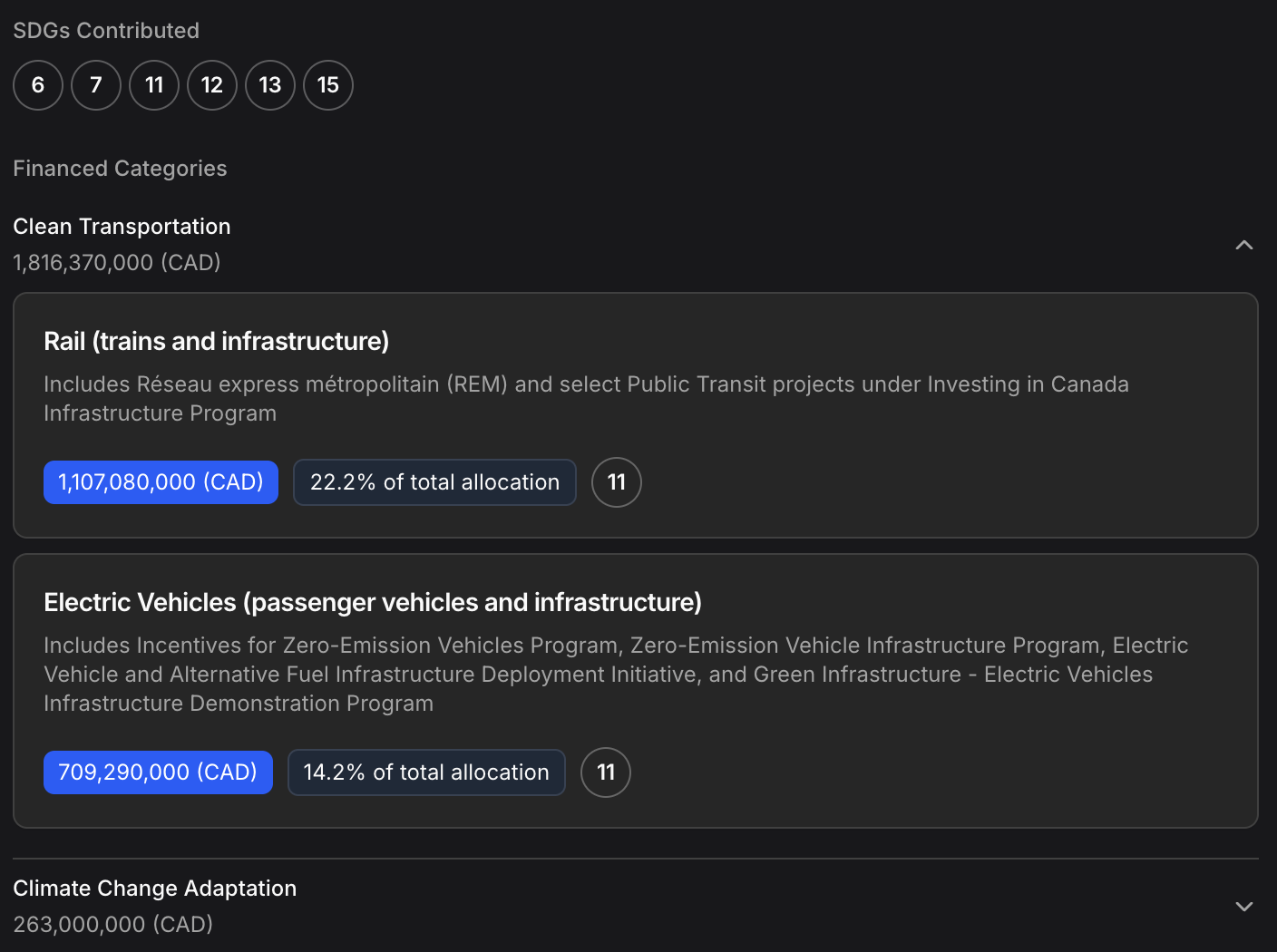

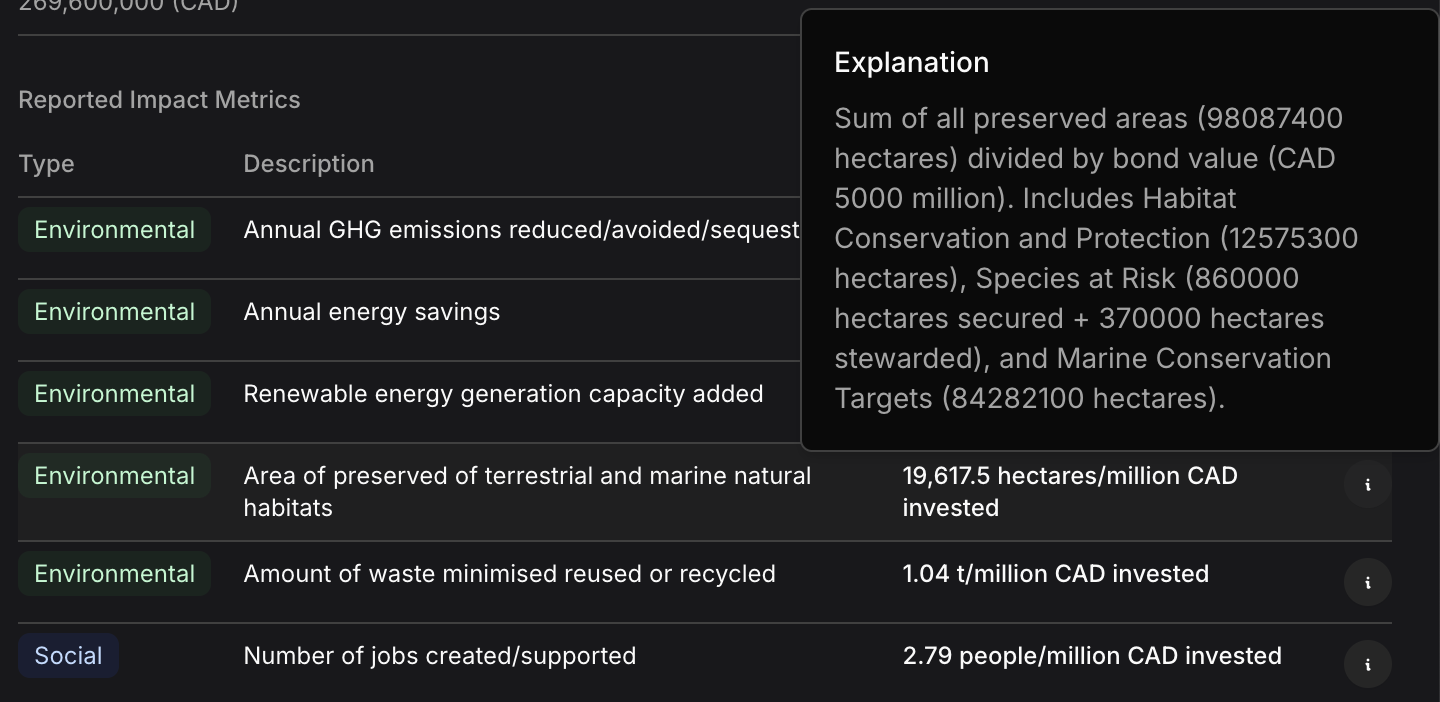

Post-issuance Reporting

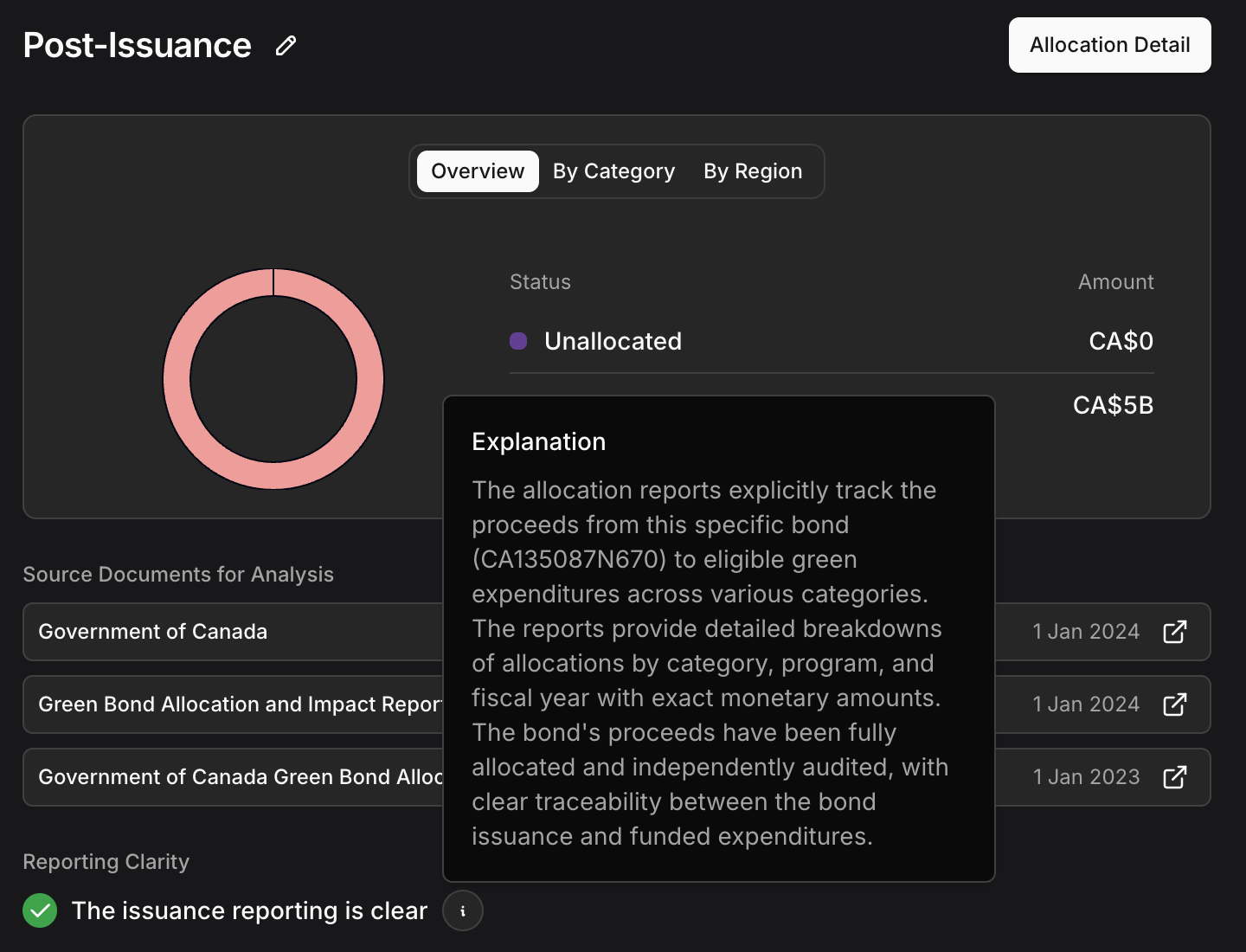

For post-issuance we extract the categories and regions of financed categories and the detailed explanations at the level of detail provided in source documents (e.g. projects if mentioned). We also include information on how much has been allocated by the latest reports (total and per category) and is still unallocated, what SDGs the categories map to and information on how well the issuance reporting was done.

Post-issuance categories

Clarity of reporting

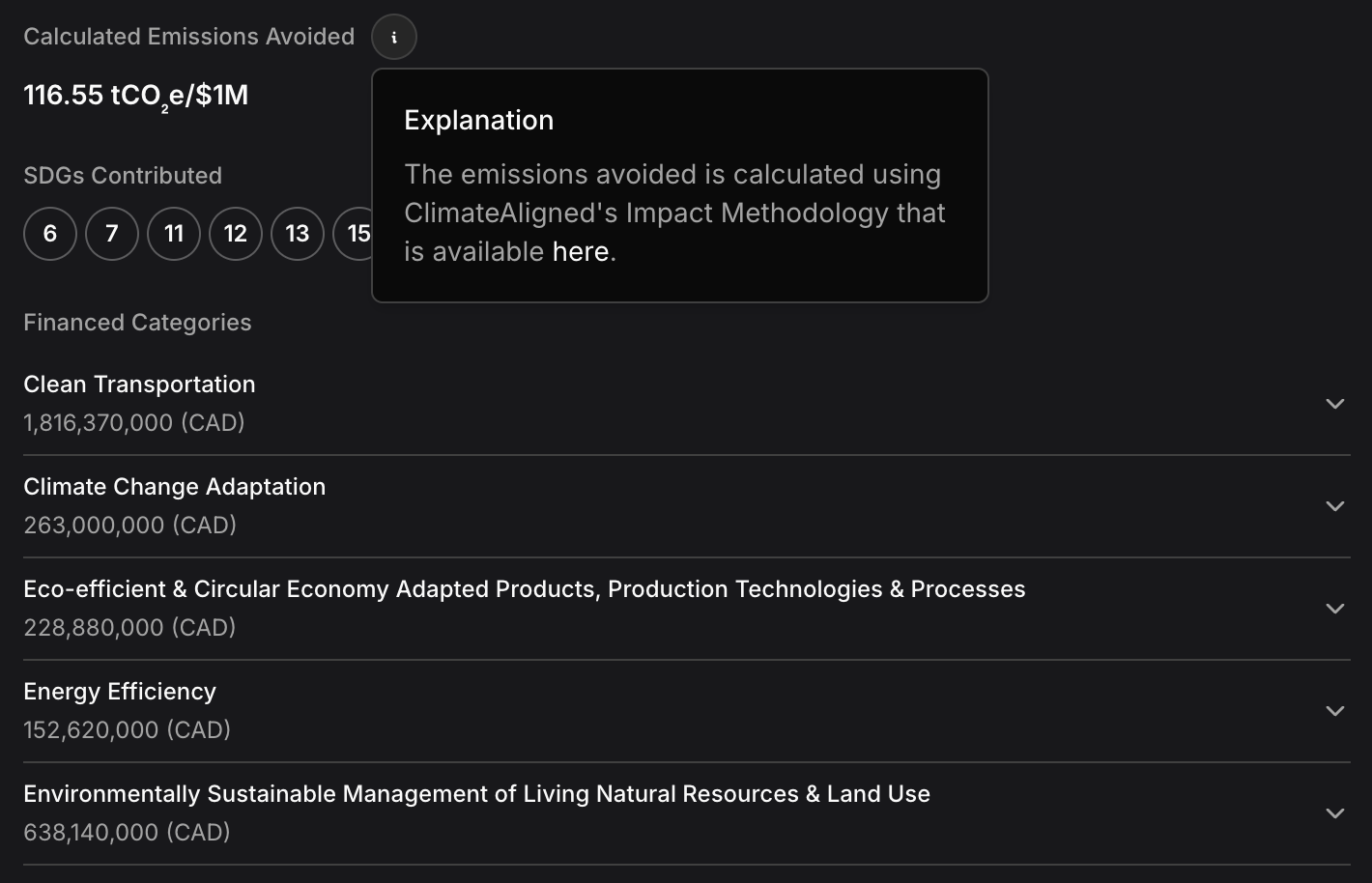

Impact Metrics and Methodology

Finally there is also detailed extractions on the reported impact metrics and explanations for them. We also calculate an estimated emissions avoided metric using our own methodology because reporting varies so much that we decided to add in a standardised emissions avoided measure.

Read our full Impact Methodology for detailed explanations.

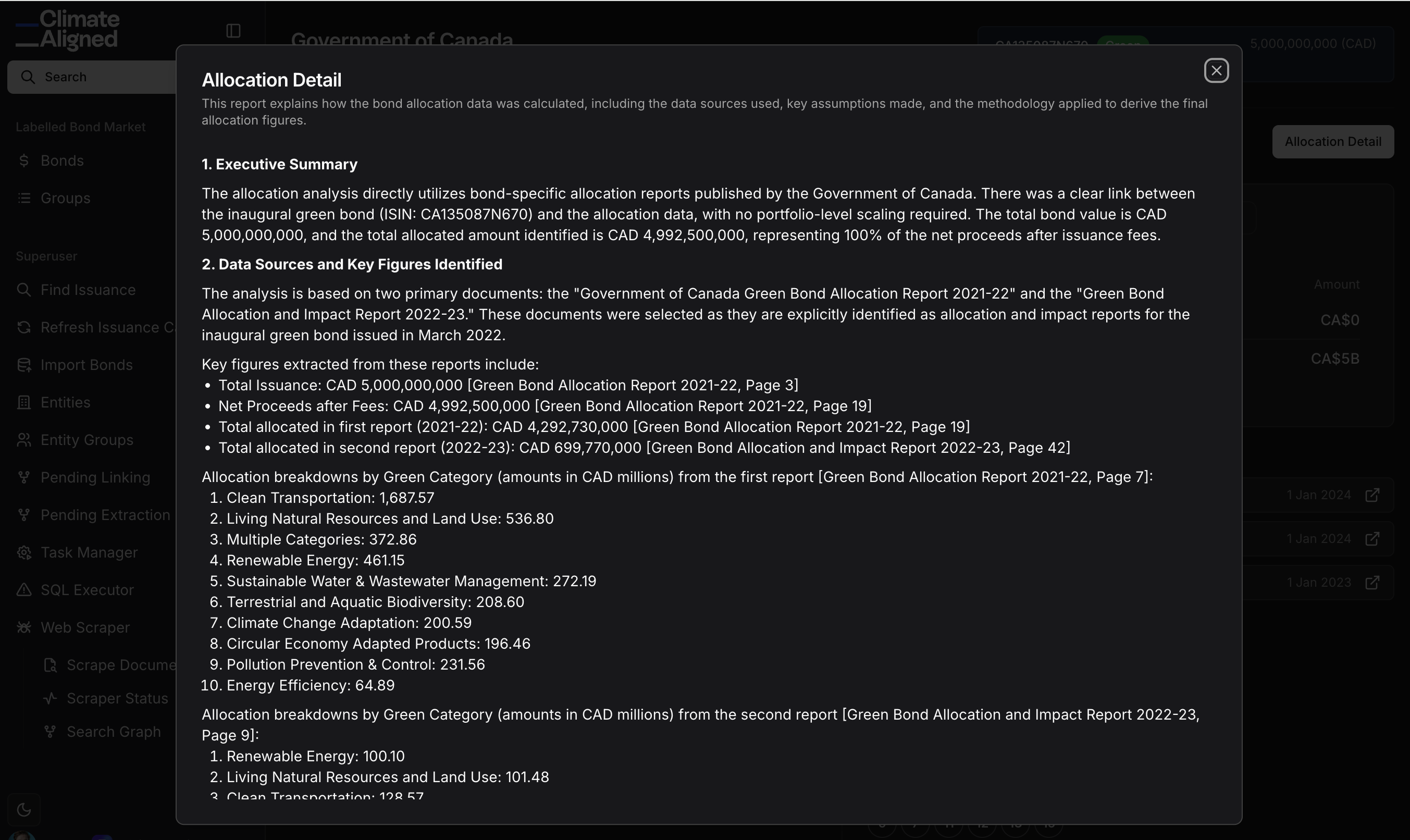

Allocation Data Traceability

We've also added detailed allocation data that shows where all the allocation information came from - which document, which page, and the reasoning our system used in analysing it, so you can verify where the numbers are coming from.

Transparent Methodologies

Explanations: transparent criteria & methodologies

Impact metrics: reported results integrated into each bond view.

6. Further Product Features

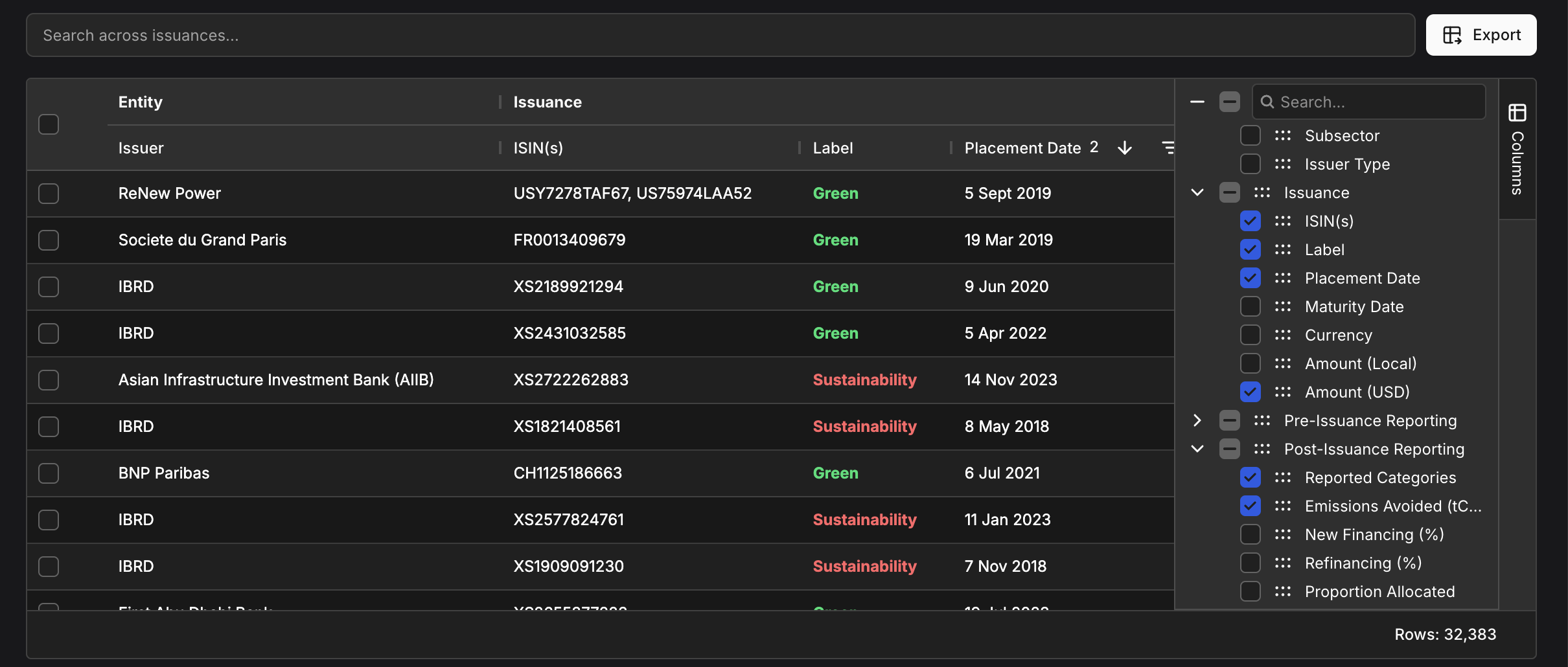

Custom Tables and Columns

Choose which columns to display, including pre- and post-issuance fields.

Selecting data fields to show

Example of customised data view

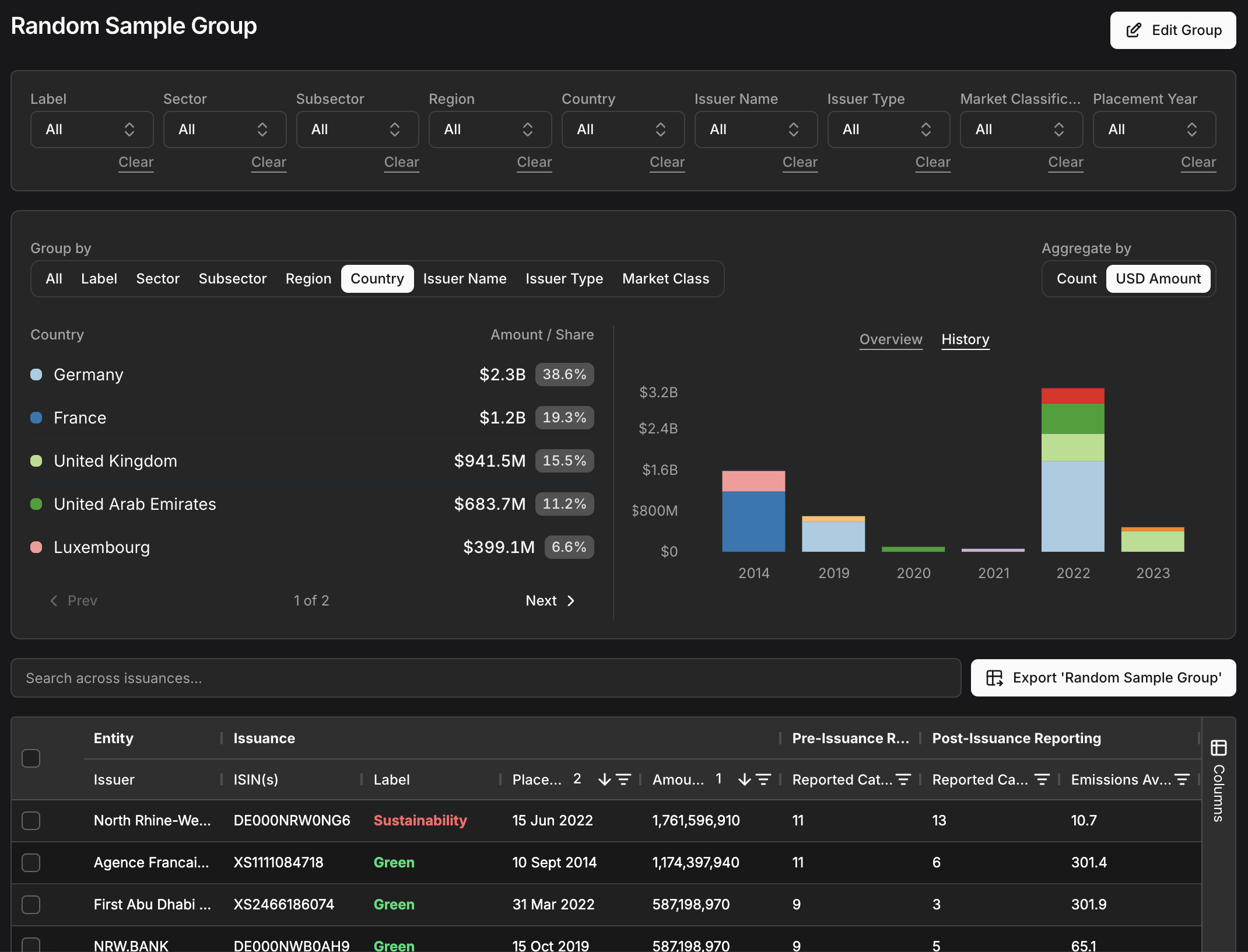

Groups

Groups: organise bonds into sets for analysis. Groups allow users to set up their portfolio holdings as a set to be able to analyse, visualise and export relevant metrics for reporting purposes.

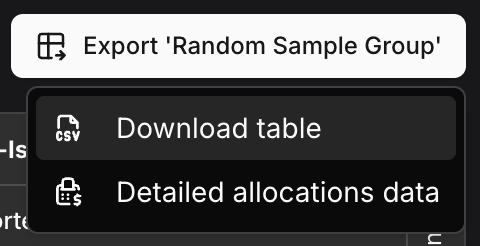

Exporting from Groups

Exporting: exports are possible from groups.

7. Trial Access

Unlimited time, 100 bonds included. Full functionality (filters, groups, exports, metrics) so you can see the richness of the data.

8. Pricing

£1,000/month or £10,000/year for a team for tracking and reporting use (ie. screening process, reporting, analysis, tracking) with a permission to distribute in investor reporting.

The monthly subscription covers exporting 100 bonds per billing month and the annual subscription covers 1,200/year, renewing every billing cycle. For higher-volume exports please reach out about your use case as we can increase it slightly where relevant or consider alternative pricing options.

For custom data exporting needs or other data services not available in the platform, we can cover them with custom data work, priced depending on the scope of the request. For high volume use, partnerships, resale, or flexible arrangements: contact us at info@climatealigned.co.

9. FAQs

How often is the data updated?

Daily bond additions with weekly sweeps and quarterly reviews.

Do you cover emerging markets?

Yes — including Asia (incl. China, Japan, Korea), South America, Africa, Middle-East (as well as Europe and North America).

Do you process non-English documents?

Yes, we process documents in French, Spanish, Japanese, Korean, Chinese, and other languages. All data from these documents is translated into English for analysis, ensuring consistency across our entire system and allowing these bonds to be seamlessly aggregated with diverse portfolios.

Which instruments are covered?

Green, Social, Sustainability, Transition, and SLBs.

What's included in the trial?

100 bonds, unlimited time, all features (except full coverage).

Can I export data?

Yes — exports available from groups.

How much coverage do you have for documents?

About 83% of issuance volume with pre-issuance docs, and 50% with post-issuance docs from 2006. Much higher on recent relevant portfolios, we rarely find that we are missing bonds - send us an ISIN list to check.

10. What's Next

We're building API access and expanding analytics features. We want to make it possible to self-check for coverage of ISINs and reporting documents as well. Sign up to our newsletter to hear about our newest data and feature additions: https://newsletter.climatealigned.co

11. Get Started Today

Start exploring today with the free trial, or contact info@climatealigned.co.uk for details.

Ready to explore comprehensive labelled bond data tailored for your investment decisions? Sign up for your free trial today and discover insights that drive better outcomes.

ClimateAligned provides comprehensive and affordable labelled bond data, helping investors and analysts make informed decisions in the sustainable finance market.